- #QUICKEN 2015 HOME AND BUSINESS ACCOUNTS RECEIVABLE HOW TO#

- #QUICKEN 2015 HOME AND BUSINESS ACCOUNTS RECEIVABLE MANUAL#

- #QUICKEN 2015 HOME AND BUSINESS ACCOUNTS RECEIVABLE UPGRADE#

- #QUICKEN 2015 HOME AND BUSINESS ACCOUNTS RECEIVABLE FREE#

- #QUICKEN 2015 HOME AND BUSINESS ACCOUNTS RECEIVABLE MAC#

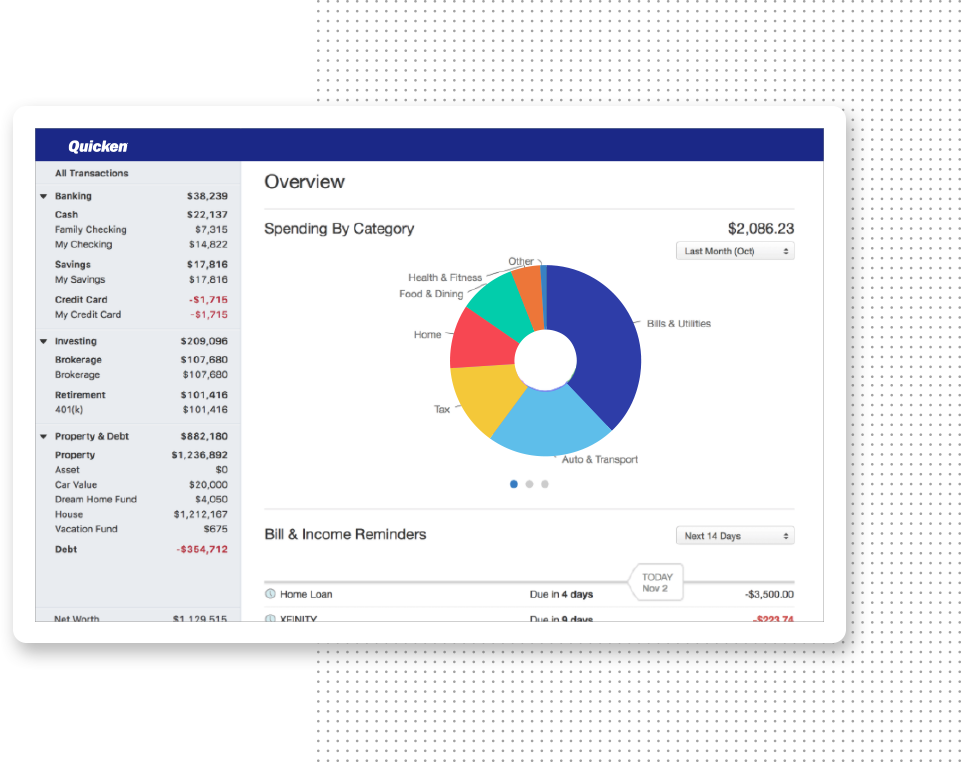

You can also create customer estimates, invoices, and statements track accounts receivable enter customer payments and track accounts payable. (This isn't recommended, for tax reasons.)īegin by deciding which Quicken accounts you need in order to track your business. Use both categories and tags to distinguish between business and personal transactions.

Set up separate Quicken data files for your home and for your business.Use the standard business categories to track business-related transactions. This lets you track all your finances in one place and do tax planning for both employment and self-employment income. Be sure that your business checking, credit card, and other accounts are used solely for your business. Add personal and business accounts in one data file, and then track both home & business finances in the same file.You can handle this three different ways in Quicken: The IRS advises business owners to keep business transactions completely separate from personal transactions. Think about how you want to track your finances, especially your checking and credit card accounts. Title Release: Intuit Quicken Home & Business 2016 R6 25.1.6.If you purchased Quicken Home & Business, you can track personal and business accounts in the same Quicken file. Increased reliability and accuracy of bank downloads and transactions* * Easily import data from Quicken Windows 2010 or newer

#QUICKEN 2015 HOME AND BUSINESS ACCOUNTS RECEIVABLE MAC#

* Now easier to convert from Quicken Windows to Quicken Mac * Easily pay your bills* on time from right within Quicken * Know exactly where you stand with your bills and cash flow without having to log into multiple accounts * Link your bills and Quicken will automatically track the due date and the amount due* Now easier than ever to stay on top of your bills

#QUICKEN 2015 HOME AND BUSINESS ACCOUNTS RECEIVABLE FREE#

#QUICKEN 2015 HOME AND BUSINESS ACCOUNTS RECEIVABLE HOW TO#

#QUICKEN 2015 HOME AND BUSINESS ACCOUNTS RECEIVABLE UPGRADE#

Even easier to get started, upgrade (to Quicken Mac or Windows), or set up new features.Easily pay your bills on time from right within Quicken.Know exactly where you stand with your bills and cash flow without having to log into multiple accounts.Link your bills and Quicken will automatically track the due date and amount due.NEW! See, track and pay your bills all in one place Makes tax time easier, as cost basis and capital gains are tracked and estimated for you.Helps you make better investing/buy sell decisions with market comparisons.See how your investment performance over time compares to market indexes.Check assets, liabilities, and net worth in one click.Organize, analyze, and optimize your portfolio Create Schedule C reports, or even export your data directly to TurboTax* Select Create New Account in the Online Account Setup section By logging in, you are agreeing with and accepting the Terms & Conditions stated within this site Select American Funds as the institution for this account, and follow the directions Select 'Investing' > 'Security List' from the toolbar Make 10 qualifying transactions per month for (3.See your year-to-date tax deduction status to avoid tax-time surprises.Easily keep track of tax deductions, such as mileage, home office, job-specific expenses, and more.Maximize deductions and simplifies your taxes See what’s coming in for the month, what’s going out, and what’s left.View an overall snapshot of your profit/loss.

#QUICKEN 2015 HOME AND BUSINESS ACCOUNTS RECEIVABLE MANUAL#

0 kommentar(er)

0 kommentar(er)